-

16:25

₹

-

Low

$12579.24

-

High

$17382.45

-

Value

$246.73 B

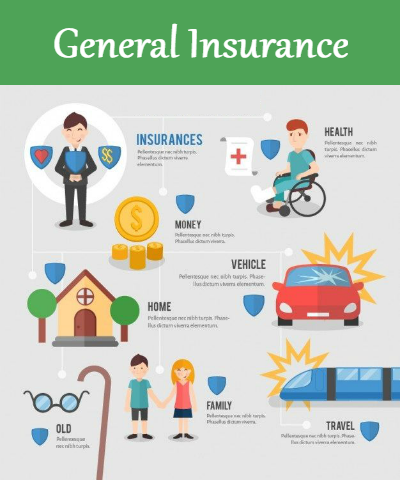

General Insurance

A general insurance is a contract that offers financial compensation on any loss other than death. It insures everything apart from life. A general insurance compensates you for financial loss due to liabilities related to your house, car, bike, health, travel, etc. The insurance company promises to pay you a sum assured to cover damages to your vehicle, medical treatments to cure health problems, losses due to theft or fire, or even financial problems during travel.

Simply put, a general insurance offers financial protection for all your assets against loss, damage, theft, and other liabilities

-

Commercial Lines

These products are usually designed for relatively small legal entities.

-

Personal Lines

These products are designed to be sold in large quantities.

-

ACORD

Has standards for personal and commercial lines and has been working with Insurers to develop the XML standards.

Types of General Insurance

-

Motor Insurance: Motor insurance is for your car or bike what health insurance is for your health. It is a general insurance cover that offers financial protection to your vehicles from loss due to accidents, damage, theft, fire or natural calamities

-

Health Insurance: This type of general insurance covers the cost of medical care. It pays for or reimburses the amount you pay towards the treatment of any injury or illness.

-

Travel Insurance: A travel insurance compensates you or pays for any financial liabilities arising out of medical and non-medical emergencies during your travel abroad or within the country.

-

Home Insurance: Home insurance is a cover that pays or compensates you for damage to your home due to natural calamities, man-made disasters or other threats.

-

Fire Insurance: Fire insurance pays or compensates for the damages caused to your property or goods due to fire. It covers the replacement, reconstruction or repair expenses of the insured property as well as the surrounding structures. It also covers the damages caused to a third-party property due to fire.

-

Marine (Cargo) Insurance: Business involves the import and export of goods, within national borders and across international borders. Movement of goods is fraught with risk of mishaps which can result in damage and/or destruction of shipments. This leads to substantial financial losses for both the importers as well as the exporters.

-

Rural Insurance: Insurance solutions to meet the needs of agriculture and rural businesses form part of rural insurance. IRDA has stipulated annual targets for insurers to provide insurance to the rural and social sector.

-

Commercial Insurance: Commercial insurance encompasses solutions for all sectors of the industry arising out of business operations. Insurance solutions for automotive, aviation, construction, chemicals, foods and beverages, manufacturing, oil and gas, pharmaceuticals, power, technology, telecom, textiles, transport and logistics sectors. It covers small and medium scale enterprises, large corporations as well as multinational companies.